As an audiologist, it is essential to educate patients about every aspect of their hearing aids, including the Loss and Damage (L&D) policy. Hearing aids are highly valuable, delicate devices that require careful handling and maintenance. While proper care can extend their lifespan, accidents, theft, or loss can happen unexpectedly. Understanding the details of your L&D policy ensures that you can protect your investment and enjoy continued hearing improvement without unnecessary financial stress.

Understanding the Loss and Damage Policy

A hearing aid Loss and Damage policy acts much like an insurance plan. It provides protection against accidental loss, theft, or irreparable damage to your devices. For most patients, this coverage is included at no extra cost with professionally fitted hearing aids, giving peace of mind and security from day one.

Loss Coverage

If your hearing aid is lost or misplaced, loss coverage allows for a replacement at no cost or a significantly reduced cost, depending on the manufacturer’s terms. This coverage typically lasts as long as the device’s warranty—commonly two to three years. Most L&D policies allow one-time use per hearing aid, meaning you can replace your right device once and your left device once during the coverage period.

Damage Coverage

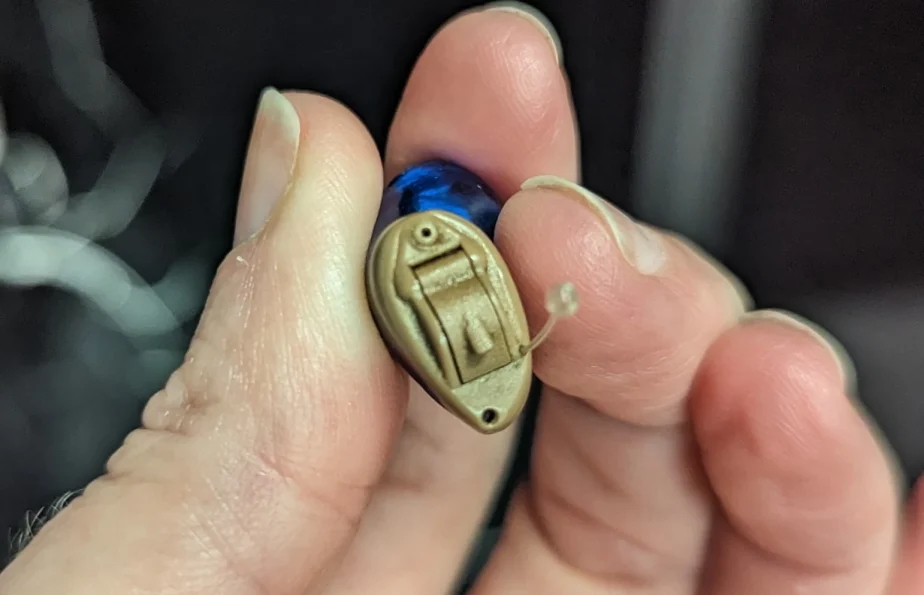

Damage coverage applies when your device suffers physical harm. Examples include dropping and breaking the casing, moisture damage, or situations like a dog chewing the hearing aid. If you have all or most of the pieces, repairs are typically covered under the manufacturer’s warranty and can be done multiple times. The one-time L&D replacement is only used if no repairable parts are returned.

Theft Coverage

Some policies also protect against theft. If your hearing aids are stolen, the policy can provide reimbursement or replacement. This situation would count toward your one-time L&D replacement, and most providers require a police report as proof before processing the claim.

Benefits of Having Loss and Damage Coverage

Choosing hearing aids with an L&D policy offers several valuable advantages:

- Financial Protection: Hearing aids are a major investment, and sudden loss or damage can be costly. Coverage reduces or eliminates the expense of replacement or repair.

- Peace of Mind: Patients can engage in daily activities with confidence, knowing that accidents, theft, or loss will not mean the end of their hearing care.

- Convenience: The claims process is typically straightforward, with faster turnaround times and service through authorized repair centers.

- Longevity of Devices: Prompt repair or replacement ensures that hearing aids remain functional, extending their useful life.

Duration of L&D Policy

Most Loss and Damage policies match the length of the manufacturer’s warranty—commonly two or three years from purchase. Terms vary by brand and clinic, so patients should always review their paperwork to confirm specific coverage details and expiration dates.

Programming Fees for Replacement Hearing Aids

Patients purchasing unbundled hearing aids—those not packaged with fitting, adjustments, and follow-up care—should be aware that replacement devices may incur additional programming fees. Always confirm potential service charges with your provider before finalizing your purchase.